How To Lower The Cost Of Building Wealth

A healthy relationship with money means that you can balance your immediate and longer-term lifestyle desires and needs, the most expensive and non-optional of which is financial independence – that stage when you have enough money to make paid work optional.

The key variables that will affect your ability to build financial assets are the amount you save, the returns you achieve on your money and the period of time your money is invested.

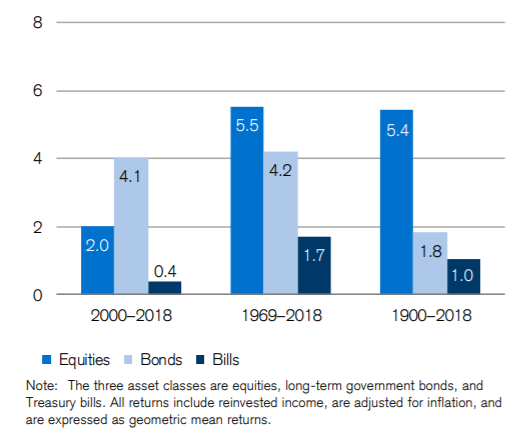

According to the Credit Suisse Global Investment Returns Yearbook 2019, the real (post inflation) annualised return on global (market weighted) equities and bonds around the world from 1900 to 2018 have been 5% and 1.9% per annum respectively (in US$ terms), while from 2000 to 2018 they were 2.1% and 4.6% respectively. The worst yearly real return since 1900 was -31.6% in 1919 and the best was 46% in 1933.

The stockmarket enables millions of investors to buy and sell part shares of companies. Every day those values change based on supply and demand. If there are more buyers than sellers, then prices rise. And if there are more sellers than buyers, then prices fall. Sometimes values fall and rise a lot – as much as 50% or more.

Benjamin Graham was a finance professor who taught legendary billionaire investor Warren Buffett the principles of investment. Graham is reported to have said “In the short run, the [share] market is a voting machine but in the long run, it is a weighing machine.”

“In the short run, the [share] market is a voting machine but in the long run, it is a weighing machine.” ~ Benjamin Graham, legendary investor and finance academic

In essence Graham was sayings that, while share values move around from day to day based on sentiment, emotions and supply and demand, in the long-term investors’ returns reflect the reality that most companies’ profits and the cash dividends they pay out, tend to rise over time, thus supporting higher valuations.

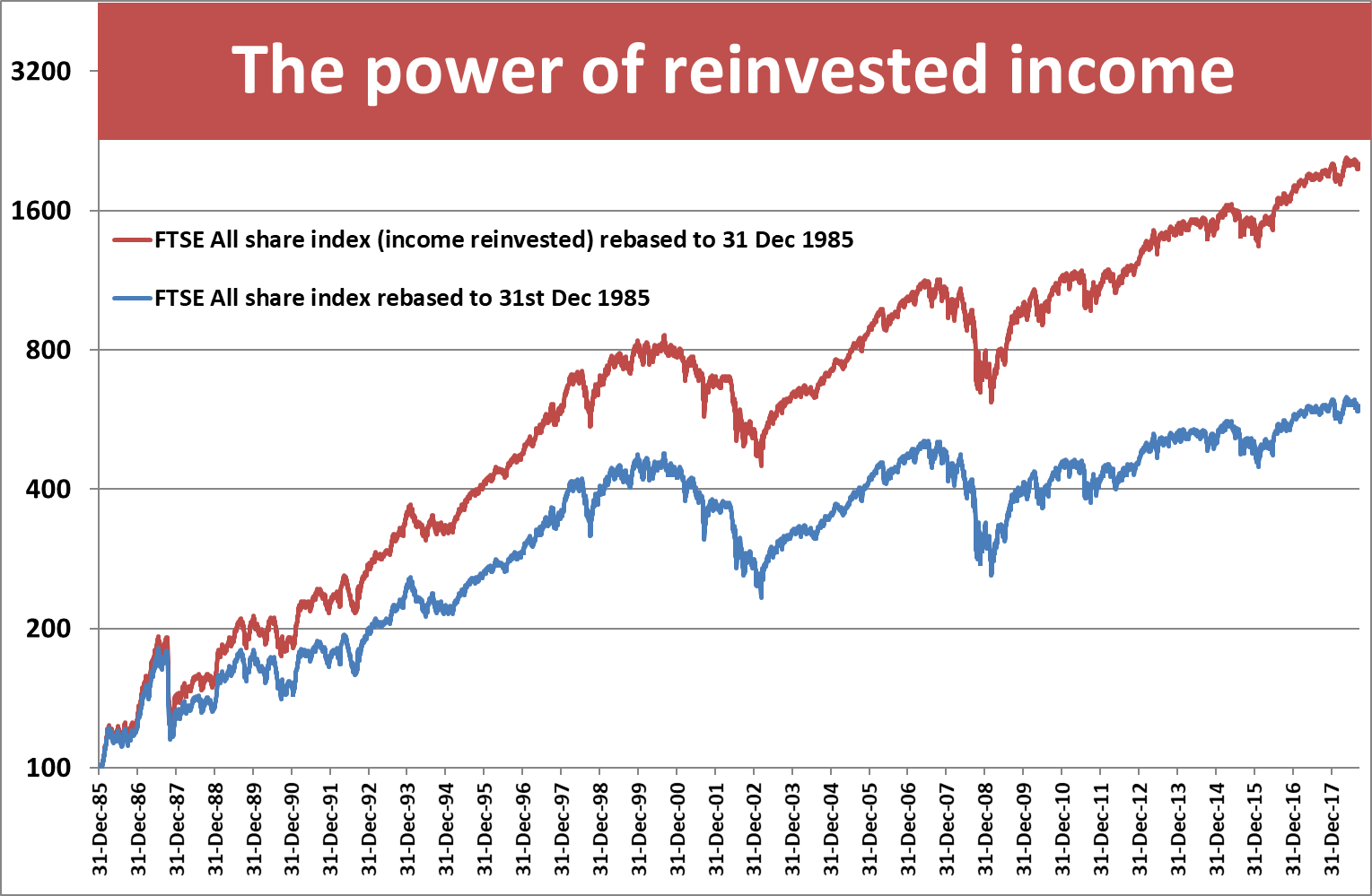

But even more importantly, if investors reinvest all dividends arising within their portfolio, they will make even more money due to the magic of what is known as compound interest. The chart below shows the importance of reinvesting dividends in the UK stockmarket over a 32 year period. As you can see, the index value with reinvested income is in the region of 250% higher than without.

Source: Chart - Paul Claireaux. Data - FTSE the Index company

It’s also worth noting that investing regularly for the long term reduces your risk of picking a bad time to get into the investment markets. Indeed, any big falls in market prices early on in your savings journey could work in your favour, because you then pay lower prices for your shares with your future payments.

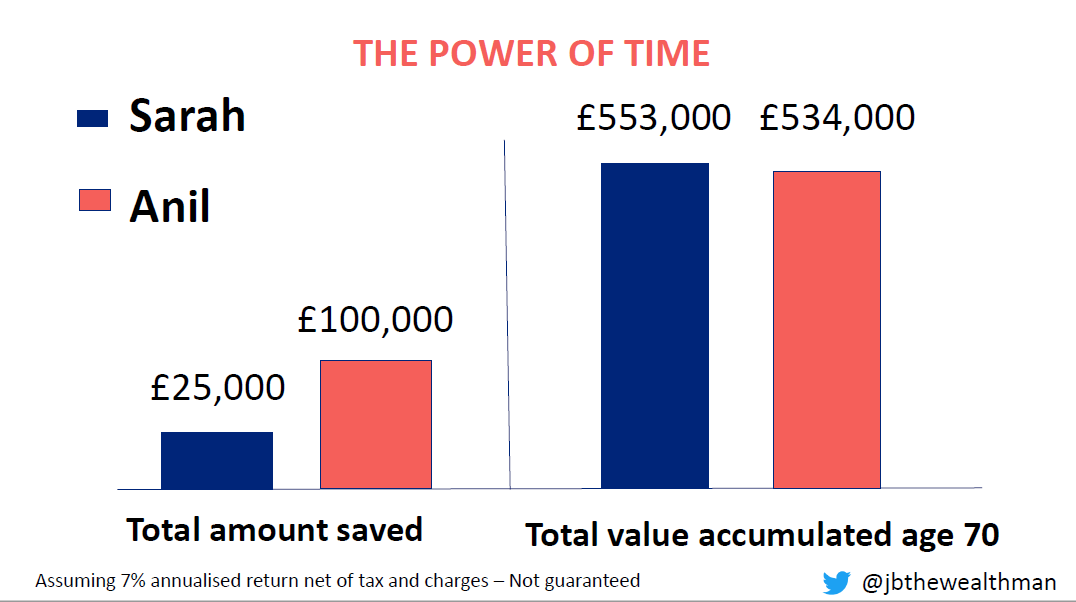

To understand the real power of investment compounding let’s look at the example of two young graduates, who adopt different approaches to saving and investing.

Sarah got her first job when she was 21. She didn’t earn a very high salary, but she kept her lifestyle spending low and managed to save £2,500 each year into a stockmarket based investment fund held within a tax-free individual savings account (ISA).

Sarah continued saving the same amount each year until she was 30, when she stopped saving into her stocks and shares ISA, as she needed to spend her income on other shorter-term priorities.

Anil started work at the same time as Sarah, when he was also 21. But he didn’t bother saving any of his income, and instead spend it on enjoying himself. When he turned 31, Anil started saving £2,500 per annum into a stockmarket based investment fund held within a tax-free individual savings account (ISA) and continued to do this until he was 70.

By the time they were both aged 70 Sarah and Anil’s ISAs had earned the same investment return of 7% per annum. Sarah’s ISA had grown to £553,000, a return of 22 times the £25,000 she invested (10 x £2,500), whereas Anil’s ISA had grown to £534,000, a return of 5 times the £100,000 he invested (40 x £2,500).

Despite Sarah investing only a quarter of the amount that Anil invested, her ISA was worth £19,000 more than his, purely because of her money being invested for ten years longer than Anil.

If investment returns in the future are lower than 7% per annum, then the final fund values would obviously turn out to be lower than in this example. But whatever the long-term return, the key message is the same. Start saving early, invest wisely in investments that have the potential to generate a return higher than inflation, and stay invested for the long-term.