Be Kind To Yourself

Barely a day goes by without something in the media or online about the financial challenges facing young people. Whether it’s the spectre of leaving university with massive student debt, the high cost of housing, or the impossible task of saving for older age, the narrative is the same. A sense of unfairness, future hardship and impossible barriers to high financial wellbeing.

When you are faced with what looks like an impossible task, it’s easy to get overwhelmed and feel powerless to improve your situation. Not feeling in control of anything in life can be upsetting, but when it comes to money matters, it can have a serious impact on your mental and physical health.

Rather than focus on key financial life goals, which might seem difficult or even impossible to achieve – such as buying a house or retiring in comfort – it’s much better and far more productive to focus on improving your daily money habits and behaviours. As habits expert James Clear puts “Each action you take is a vote for the type of person you wish to become.” or remain.

The person you want to become (or maintain) is your identity, and all habits are formed in the context of that identity. If you see yourself as a powerless victim, who is no good with money, then it’s easier to develop and tolerate money habits which align with that image.

If, however, you see yourself as someone who deserves and expects to have life choices, is disciplined and patient and has an abundance mindset, then it will be easier to develop effective money habits that improve your financial wellbeing. The other thing about focusing on small daily habits is they are tangible, immediate and something over which you can have control.

Contrary to conventional wisdom, that developing a new habit takes 21 days, the evidence suggests that a new habit takes between 2-8 months to become ingrained, depending on the frequency the habit is carried out.

As well as making sure it’s aligned with your identity, the easier you can make a habit and the greater the immediate reward you receive from it, the more likely you’ll be successful at maintaining it over the long term. Forgoing that second daily coffee to enable you to build up £1,000 emergency savings in 12 months, is easier if you avoid the temptation of the coffee shop in the first place and give yourself a small reward for each month that you save £80.

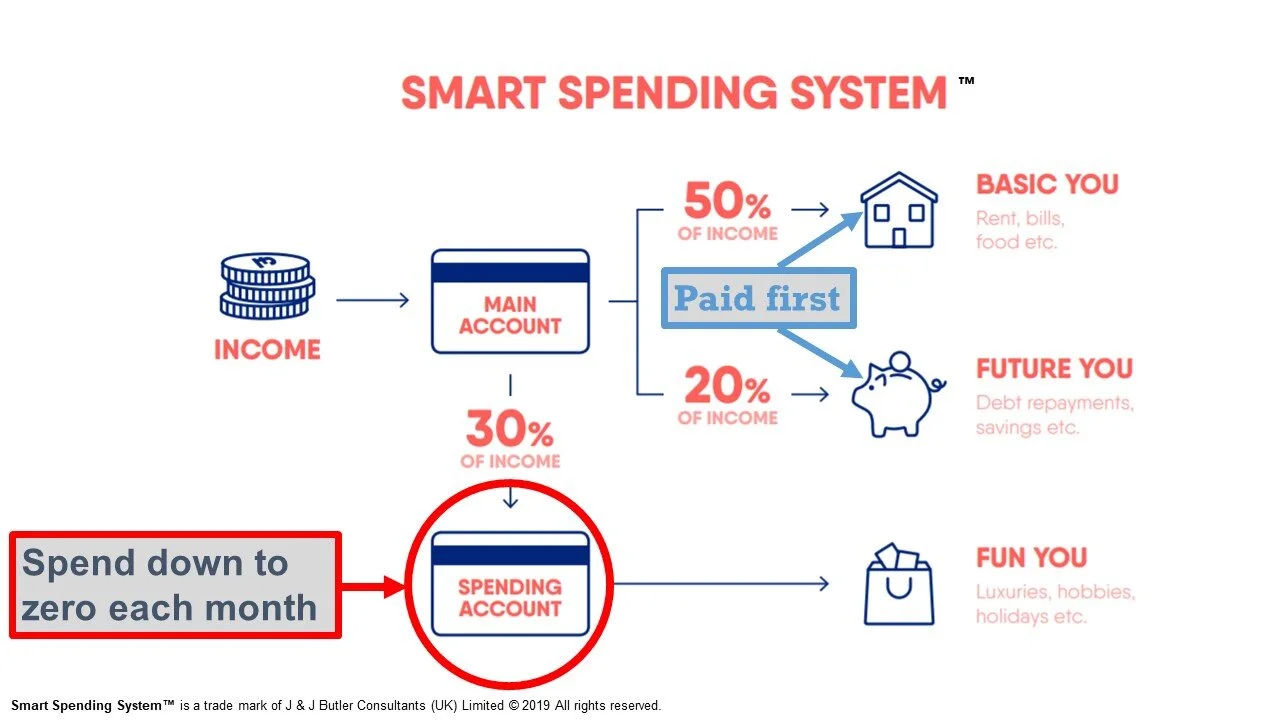

My Smart Spending System, illustrated below, is one way of making it easier to develop better daily habits.

I find it much easier to control my discretionary spending and to avoid feeling guilty for that spending by adopting this approach, as I don’t have to think about it, other than how much ‘fun’ money have left as I progress through each month.

Making small changes to your daily money habits is within your grasp. Start small with a few habits, rather than with lots of changes, and sustain them. Over time you can add and change other money habits, and gradually you’ll start to feel better about your ability to make wise money choices.

As the ancient Stoic philosopher Hecato said “What progress, you ask, have I made? I have begun to be a friend to myself.” You too can be a friend to your current and future self by focusing on making progress with your daily money habits.

Let me know how you get on.

Warm regards,

Jason