The True Cost Of Love

If you are single but looking for that special person to share your life with, what do you look for in a potential soul mate? A sense of humour, shared interests, sexual chemistry, emotional connection, social status or financial security?

I remember an ex-colleague who was looking for her ‘perfect’ life partner and had drawn up a list of about 20 attributes that she was looking for. I told her that, while it’s good to have high standards, I doubted there was a man alive who would measure up to her ideal. She did eventually find and marry a nice man and they now have a lovely home and a young daughter.

Everyone is different and will place emphasis on different attributes. The problem can be that when you first meet someone, you see the image of the person that they want you and you want to see. This can mean that the true person is submerged beneath your reality distortion filter.

Money and Love

In most cases it is only over time that you find out the true person and one of the last aspects to get clarity on is your new love’s relationship with and ability to manage money.

The trappings of materialism and consumption might suggest someone who is financially successful. Or it might be masking the fact that they are up to their eyes in credit card and overdraft debt because they can’t control their spending.

The fact they are renting their accommodation might mean they are taking their time to save up to buy and leave their options open. Alternatively, it might mean their last home was repossessed or their credit score is so bad that they can’t get a normal mortgage.

If they are reticent to do things that involve spending money, it might mean that they are super careful with their money and value things that money can’t buy. Or it might mean they had a bad experience with money in a previous relationship or when they were growing up and fear being poor and not having choices.

Building a Nest Together

And even if your new love has a good relationship with money and has a good handle on how to earn, spend, save and invest responsibly, their past might still come back to cost you money if you end up buying a home together.

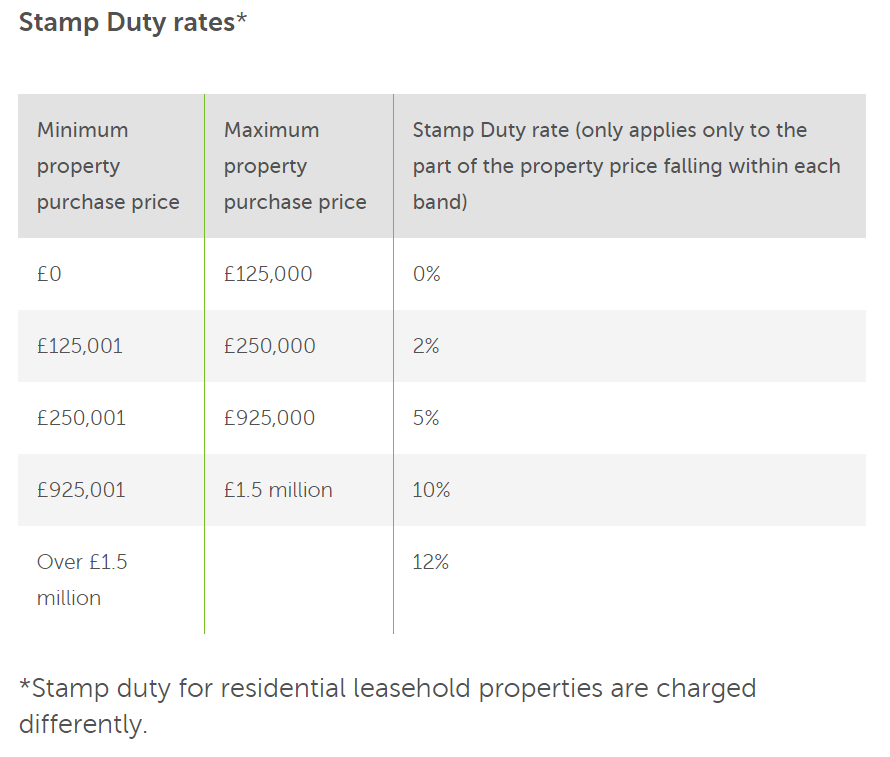

In England and Northern Ireland, you pay a purchase tax, known as stamp duty, when you buy a residential property worth £125,000 or more (or £40,000 if a second home or investment property).

The First-Time Buyer Discount*

If you are a first-time buyer and buying a home worth £500,000 or less, you pay no stamp duty on the first £300,000 and 5% on the value between £300,001 - £500,000. So, you’d pay £10,000 stamp duty on a £500,000 property rather than £15,000 - a saving of £5,000.

The first-time buyer discount in Scotland is less generous and details can be found here.

There is no first-time buyer discount in Wales and details of the tax can be found here.

A first-time buyer is defined as someone who is buying their first and only home and they have never owned a home anywhere in the world. When buying jointly, therefore, you both need to qualify as first-time buyers, and this is where problems can arise with couples buying their first home together.

You can also lose first-time buyer status if either of you have ever owned a property as a result of inheritance or as a beneficiary of a trust.

It’s easy to determine if you or your partner has ever bought a property before, but you can also lose first-time buyer status if either of you have ever owned a property as a result of inheritance or as a beneficiary of a trust. Both situations are more common than you might think but are not always apparent to those affected.

If you claim the first-time buyer stamp duty discount but have owned a property before and the tax authority finds out, as well as having to pay the tax and interest you can also incur a penalty of up to £5,000, so it’s essential to make sure you know the facts.

Your soul mate doesn’t need to be rich or a high earner, but if they are good at managing their day to day spending and make wise financial choices, you’re less likely to experience stresses and strains about money. If they also happen to qualify as a first-time homebuyer, that’ll be a welcome bonus!

Warm regards,

Jason

*In response to the economic shocks relating to the CoronaVirus pandemic, between 8th July 2020 and 31st March, you only start to pay Stamp Duty Land Tax on the amount you pay for the property above £500,000, whether or not you are a first time buyer. The additional charge for second properties, remains unchanged.