Millionaire Mindset

There are many definitions of what it means to live a good life.

Having enough money to avoid the misery of poverty is likely to be a key element. But so is being able to choose how you spend your time and afford things that make life more varied and exciting.

While the news is full of tales of woe about how hard it is for people to get ahead financially, it rarely discusses how to actually build wealth.

Begin With the End in Mind

Let's keep things simple and focus on building £1m from saving over a working lifetime.

Housing wealth is a large part of many people's net wealth and a form of enforced savings. But I want to focus on how much you'd need to save and invest each month to accumulate the symbolic amount of £1m (or dollars or euros).

A fund of £1M could probably fund a lifestyle costing around £40,000 per annum. This compares to the £33,000 (single) and £47,500 (couple) yearly cost of a comfortable retired lifestyle estimated in recent UK research. [1]

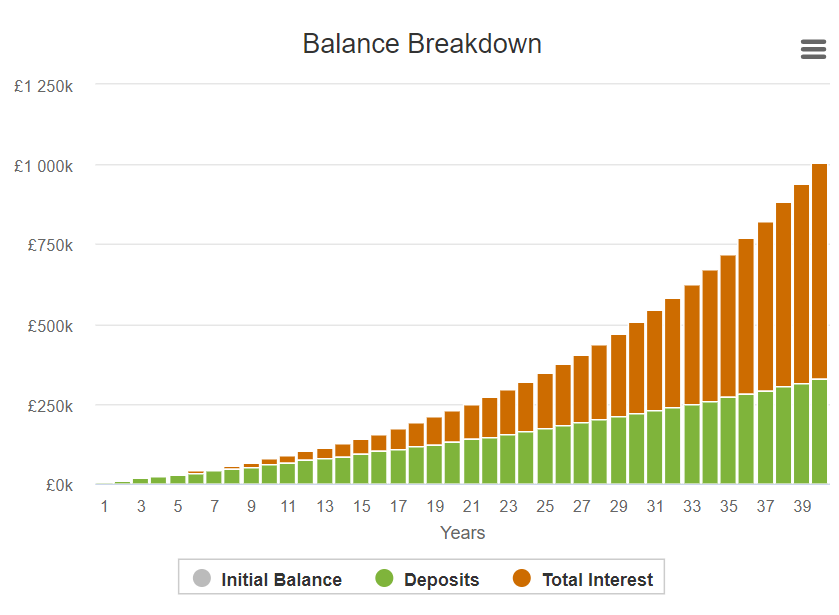

Let's assume that you saved £450 per month and increased this each year in line with inflation and that your money grows by 5.5% pa net of costs and after inflation.

After 40 years you would have a fund of £1,005,400 (in today’s money) as the chart below shows.

Source: thcalculatorsite.com

The median after-tax annual income for non-retired households in the UK was £32,100 in the financial year ending 5th April 2020. [2] Assuming a marginal tax rate of around 15% on that income (to account for the tax-free personal allowance and the possibility of two earners), that suggests UK median pre-tax household annual income is around £37,800 per annum.

My Money Milestone 5 is to put 15% of your gross annual household income into retirement savings. The median working household in the UK should, therefore, be saving £472 per month to retirement, which is a bit higher than we used in the £1m projection above.

A Lot of ‘Ifs’

I know that the investment projection relies on a lot of 'ifs'.

If investment returns achieve 5.5% per annum after inflation.

If contributions will continue uninterrupted for those 40 years.

If contributions increase by 2% each year.

If the tax treatment of contributions, returns and eventual benefits remains the same.

But the future is always uncertain and spurious accuracy isn't the point.

By establishing the habit of saving and investing at least 15% of your gross household income when you are young, and investing it wisely, you maximise the chance of financial success.

Even if you fall short of the £1m, you'll still have a very decent financial fund to make paid work optional.

But I Can't Afford to Save!

There will always be a reason why you can't save, and there will always be more pressing demands on your money in the present. But the fact is for most people this is an excuse, and they instead choose to spend their money on things that bring them immediate pleasure or recognition.

Recent research found that the average cost of a car is around £400 per month, including £266 for finance costs. [3] And when you consider that this is an average and also that many households run TWO cars, a significant number of families will pay a lot more than £400 per month on vehicles.

A flashy new car is not essential. Building wealth, so you have freedom of choice, independence and dignity in later life is.

“A flashy new car is not essential. Building wealth so you have freedom of choice, independence and dignity in later life is.” Tweet This

The Attributes of Self-Made Millionaires

A recent study of 10,000 millionaires in the United States found that 79% received zero inheritance from their parents.[4] Of those who did receive an inheritance, the majority received less than $100,000. So not enough to make them a millionaire.

The majority of the millionaires in the survey (79%) built most of their wealth through their employer-sponsored retirement plan, not esoteric or high-risk investments. But they also understand that risk is something to be managed, not avoided.

The majority of these self-made millionaires achieved their wealth milestone by the age of 49 after decades of diligent earning, saving and investing. And 70% of them regularly saved more than 10% of their income throughout their working years.

They got rich slowly!

The survey found that there are five key characteristics to which millionaires attribute their financial success.

They take responsibility.

They practice intentionality.

They are goal-orientated.

They are hard workers.

They are consistent.

Becoming a millionaire isn't the be-all-and-end-all of happiness and wellbeing. But it will make life a lot more comfortable and give you a lot more choice.

It is possible to build a meaningful amount of wealth. But it won't happen without focus, discipline, patience, clear priorities and developing effective daily spending habits and behaviours.

Check out my 8 Money Milestones now to see what you need to do to get on the path to building your first million.

As the Stoic philosopher, Seneca said over 2,000 years ago, "Luck is what happens when preparation meets opportunity."

It's time to start preparing.

Notes:

[1] https://www.plsa.co.uk/Press-Centre/Press-Releases/Article/PLSA-launches-Retirement-Living-Standards

[2] Office for National Statistics - Average household income, UK: financial year ending 2020 (provisional) https://www.ons.gov.uk/peoplepopulationandcommunity/personalandhouseholdfinances/incomeandwealth/bulletins/householddisposableincomeandinequality/financialyearending2020provisional

[4] Ramsey Solutions Inc Study of 10,000 millionaires living in the United States conducted between August 2017 – March 2018, as quoted in Everyday Millionaires: How Ordinary People Built Extraordinary Wealth – and How You Can Too, Chris Hogan, Ramsey Press (2019).