How To Stop Your Emotions Keeping You Poor

The past six months have been a rollercoaster ride for anyone who has capital invested in the stock and bond markets. And given that most people have some form of pension savings, that means almost everyone is affected. Shortly after COVID-19 raised its ugly head, global investment markets fell about 30% during March and April, as investors took fright and headed for the perceived safety of gold, government bonds and cash.

BBC News reporting the share slide in February 2020, but worse was to come in March.

But as we headed into the summer, markets quickly rebounded as investors decided that the world wasn't going to hell in a handcart and that markets looked attractive once again.

As I've explained before, stock markets are voting machines in the short-term, driven primarily by human emotions, particularly fear and greed. As the chart below shows, these emotions follow a predictable path.

Source: Barclays, Adapted from Westcore Funds / Denver Investment Advisors LLC 1998

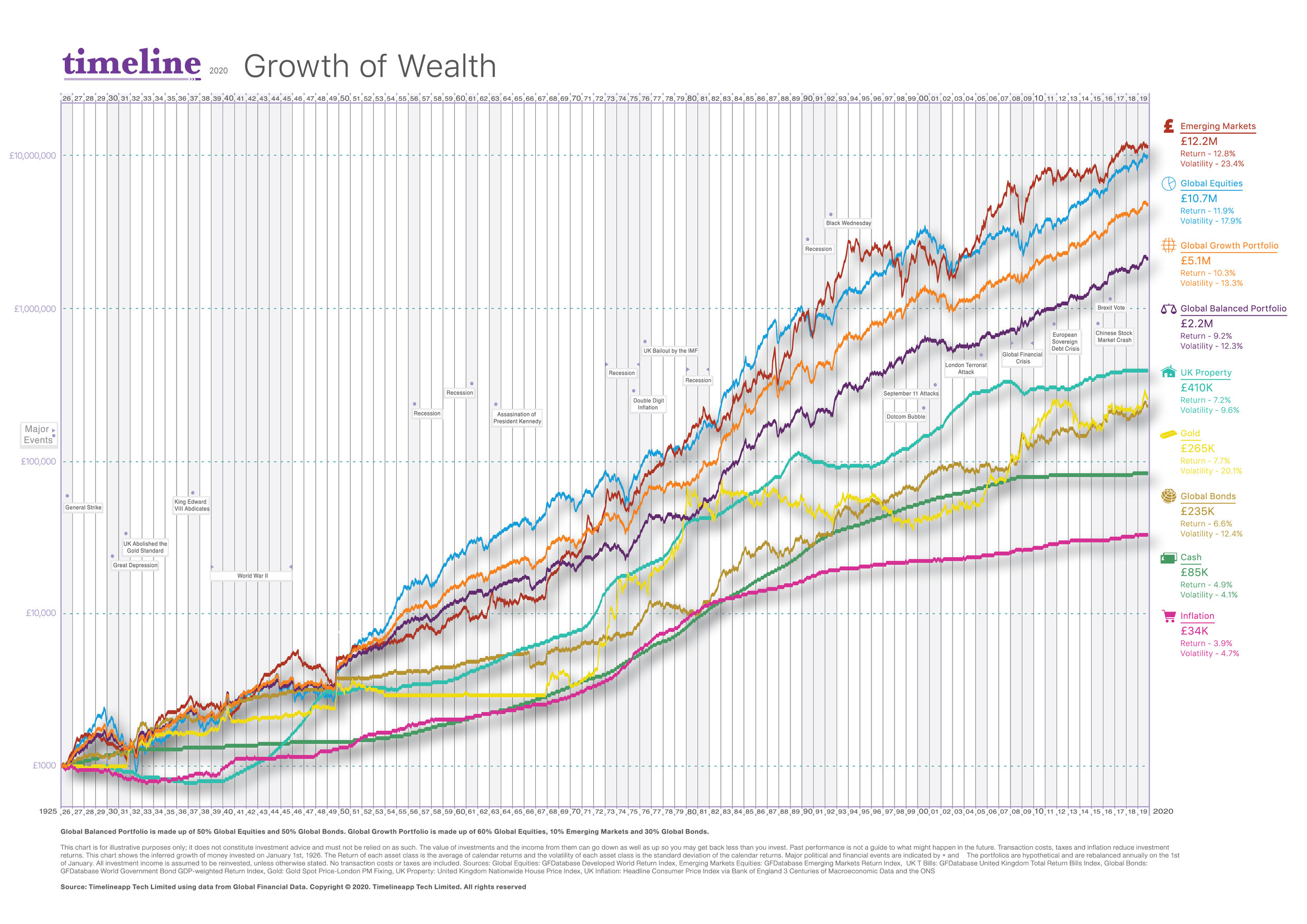

But in the long-term, stock markets are weighing machines, reflecting the profits made by underlying companies, whether paid out via dividends or reinvested within the business. The chart below shows the total return (with dividends reinvested) of a typical portfolio invested in a globally diversified portfolio of 50% shares and 50% bonds over 100 years.

Timelineapp.co

Compound interest is the principle that describes when money makes more money and, over the long term, creates exponential growth, as shown in the previous chart.

In the video below I explain how returns accelerate as the holding period increases. In my example, it takes only five years to generate the same performance as it took the first nine years.

But to benefit from compounding you have to do two things—the tedious, hard slog of building up capital and investing it, and being patient and leave the money alone to compound returns. As Warren Buffett's business partner Charlie Munger advises, “The first rule of compounding: Never interrupt it unnecessarily.”

But because investment markets are very volatile, and humans make money decisions primarily on an emotional level, being patient is easier said than done.

“To benefit from compounding you have to do two things — the tedious, hard slog of building up capital and investing it, and being patient and leave the money alone to compound returns.” Tweet This

As a very rough rule of thumb share markets will be falling, recovering and breaking new ground about 1/3 of the time each. So, every three years or so you can expect to see the value of your capital falling, sometimes by a lot!

A bear market describes when stock markets suffer an extended fall in value. And it is called a bull market when markets are rapidly rising for an extended period. The chart below shows the historic bull and bear periods for the UK stock market over the past 100 years.

Timelineapp.co

Warren Buffett has this advice for having a successful investment experience: "Our favourite holding period is forever. If you don't feel comfortable owning it for 10 years, don't own it for 10 minutes." And in this 4 minute video distinguished finance academic Kenneth French explains why it’s so hard to profit from trying to second guess what investment markets will do.

Ray Dalio is one of the smartest investors in the world, with a personal fortune of around $18 billion. In a recent interview he said, “The one thing we know is that we don't know a lot. Diversification of asset class, country, currency, these are the most important things.”

Dalio thinks that future investment returns will be lower than in the past. But he also believes that a well-diversified investment portfolio will deliver a higher return than holding cash. And he thinks it will do it in a more stable way than making big bets on, say, gold, emerging market equities or cryptocurrency.

If you have faith in capitalism (with all its faults) and the power of humans to innovate, trade, solve problems, overcome adversity and improve global living standards, then owning a small part of the great companies of the world should generate reasonable returns over the next 50+ years.

To capture your fair share of any future investment returns, you have to make sure you have at least four money fundamentals covered:

build and maintain an adequate emergency fund (between 3-12 months' core living expenses in an accessible savings account);

devise a plan to become debt-free and execute it as quickly as possible;

continually invest in your capabilities and skills to deliver value, stay relevant and earn enough to afford to live, and save;

regularly add to your investment capital and take advantage of any tax bonuses and incentives that are on offer.

If future investment returns are likely to be lower, it means we all need to save more for longer and lower our lifestyle spending expectations. They are the only things that any of us can control. Understand that, and you are likely to have a successful investment outcome.