Facing up to the property price reality

The UK Prime Minister Rishi Sunak recently advocated people take out 30 or 35 year mortgages to make home buying more affordable in the face of higher mortgage rates. But if you follow this advice you’ll probably end up paying a very high price indeed.

Photo by Terrah Holly on Unsplash

Rising cost of borrowing

The cost of mortgages has been rising since the tail end of 2021. And while no one knows how high rates will go, the consensus seems that owner-occupier rates will probably eventually settle at around the 5% mark. The best five year fixed rate mortgage at the time of writing, for those with big deposits, is around 5.20%.

And while more houses have come to the market, they are taking longer to sell, with more and more properties still unsold after six months.

Asking prices are starting to fall, but the estate agents I know advise that agreed sale prices are around 5-10% less than ‘sensible’ asking prices.

Sellers in denial

Too many sellers still haven't woken up to the reality of the new economic conditions and have an asking price that is too high.

The Prime Minister Rishi Sunak recently suggested people extend the term of their mortgage loan beyond the standard 25 years to 30 or 35 to afford the same loan as they would have done when mortgage rates were much lower.

I have always advocated looking at house purchases in terms of monthly mortgage repayments, not how much a lender will let you borrow. You can then better compare renting to buying a similar property. This great tool helps you do a proper comparison of buying v renting based on your own assumptions.

And looking at monthly repayments means you can evaluate the purchase price in relation to the cost of borrowing. Extending the term of a mortgage does enable you to borrow more when rates are higher, but it also means that the total price you repay will be much higher.

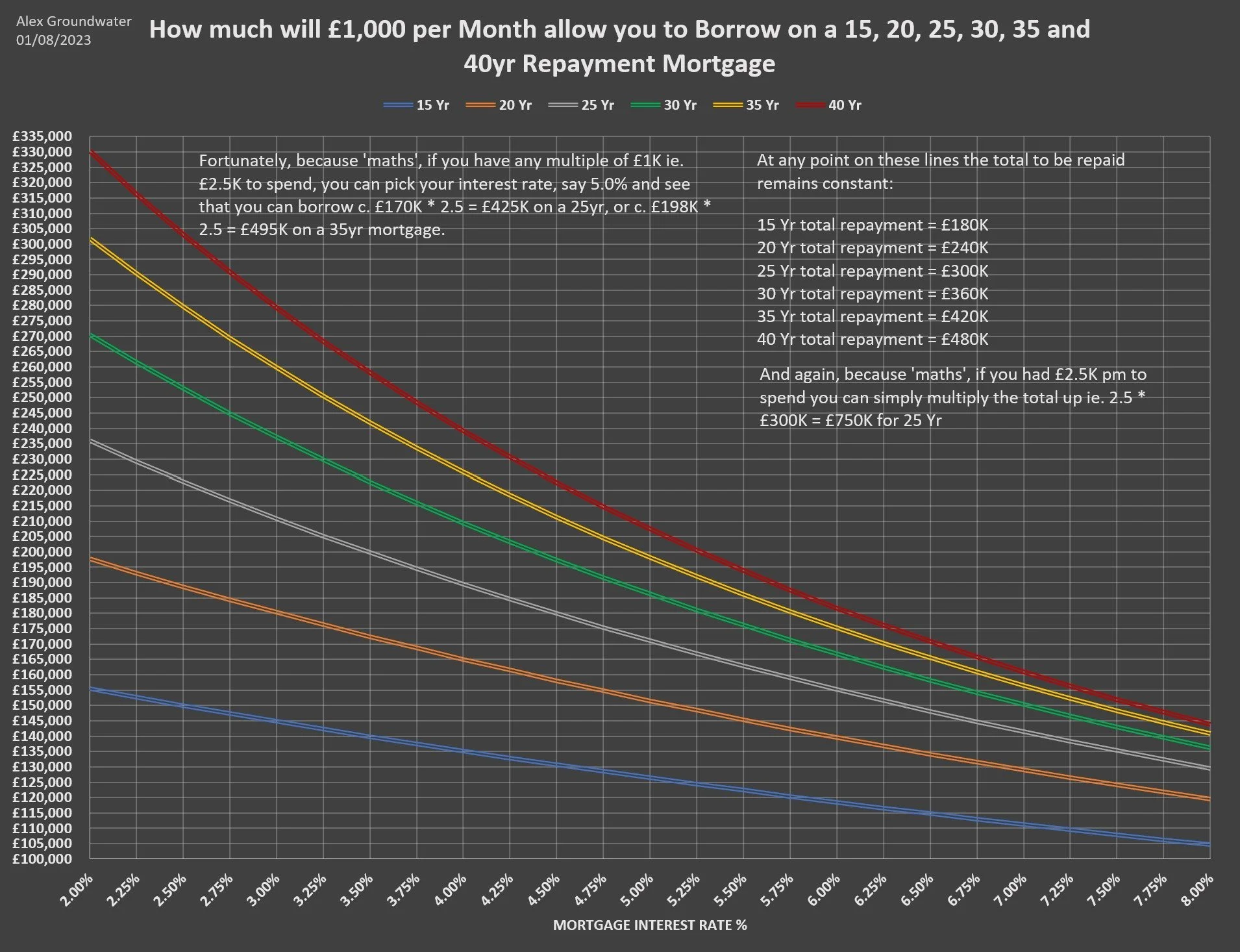

Alex Groundwater @alexgroundwater has created a helpful chart showing the amount you can borrow over different terms and interest rates with repayments of £1,000 per month.

Source: Alex Groundwater @alexgroundwater

The £250,000 house

Let's consider a house bought for £250,000 with a £50,000 deposit (20%) when mortgage rates were 3.5% (and many deals were much lower). The £200,000 mortgage repayments would have been £1,000 as per Alex’s chart.

But borrowing £200,000 today at 5.25% interest with £1,000 monthly repayments would need the term extended to 40 years. As well as the misery of mortgage repayments for 15 years longer than the usual 25-year term, the total amount repaid goes from £300,000 to £480,000. An additional £180,000!

Or look at it another way. The property in our example would need to be bought for £217,000 to bring the mortgage down to £167,000 at 5.25% to keep the mortgage repayment at £1,000 per month over 25 years. That means paying 13.2% or £33,000 less for the same house now, to make it as affordable as it was less than 18 months ago.

Buyers shouldn't extend their mortgage term beyond 25 years. They should be paying a lot less for their house!

You ain’t seen nothing yet!

I believe we have a lot more carnage to happen in the residential property market. As higher mortgage rates collide with other cost-of-living pressures, tax rises and covid-related savings reserves being depleted , household budgets will come under extreme pressure.

If you don't need to buy right now, why not wait? I think the real bargains will be had in the later part of 2024 once sellers accept reality and start capitulating.

If you want or need to buy before then, use Alex's chart to help determine the price you need to pay at today's mortgage rates on a 25-year or less term to be affordable.

Whatever you do, don't take advice from the Prime Minster or your mortgage company. They won't be the ones paying the cost of your home.

Warm regards

Jason

PS If you want to hear Alex and his friend Charlie discuss the mortgage funding chart in more detail, and hear their own views on implications for the UK residential property market, you can watch them on Charlie’s great YouTube channel here.